Credit is a game, and so is your credit score.

Your credit score can increase or decrease very rapidly, depending on your actions. It can decrease even if you think you are doing everything right and necessary to maintain a high credit score or rating.

Because banks and other financial institutions need money, it is in their best interest for people to accrue debt and thus pay interest on loans. Interest that you pay for credit is debt and interest that you receive via a banking saving account is gain, or being technical, income.

Banks and mortgage companies need you to carry debt. Paying your monthly credit card balance in full by each grace period can actually hurt your credit rating.

Some financial experts believe that the best way to keep a high credit rating or score is to maintain a little debt (via interest), which you do by carrying debt month-by-month by only paying the minimum payment due on your account on time and for just a few months (3-6 months) before paying off the entire balance owed. Although you may maintain a high credit score by doing this, you’ll stay in perpetual debt and pay hundreds and thousands of dollars in interest over the long run depending on the amount of money you owe.

Credit can be a great tool if a person has a solid financial education under their belt. If a person lacks financial education and is not financially astute, mature, responsible, and accountable, credit can become a tyrant and a slave master. You’ll be working all the days of your life attempting to pay off your debt.

While you may not be able to smoothly navigate social waters without a credit card, you are able to become financially astute and learn as much as possible about your nation’s economy and economic system, and formulate your own personal economy, an economy that does not have to follow the trend of the nation’s economy.

Intelligence and consciousness can really save you a lot of money and headaches and grief. It really can. Investing in intelligence, knowledge, information, and consciousness is far cheaper in the long run that being and remaining ignorant, uninformed, and unaware.

If you make your credit cards work for you and without harming you, they’re okay and helpful to have. On the other hand, if you’re working for credit card companies (issuers) because you’re paying off debt each month, credit cards are detrimental.

Credit cards are not the way to financial prosperity. Credit cards just allow for easier transactions in society.

Thank you for reading.

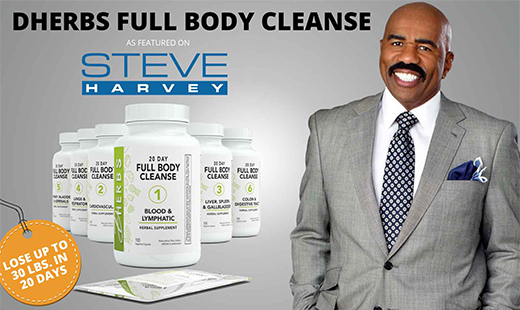

This article is compliments of DHerbs.com

Vincent Stevens is the senior content writer at Dherbs. As a fitness and health and wellness enthusiast, he enjoys covering a variety of topics, including the latest health, fitness, beauty, and lifestyle trends. His goal is to inform people of different ways they can improve their overall health, which aligns with Dherbs’ core values. He received his bachelor’s degree in creative writing from the University of Redlands, graduating summa cum laude. He lives in Los Angeles, CA.